Chart of the Month | August 2024

Market Volatility is the Price of Admission for Investing

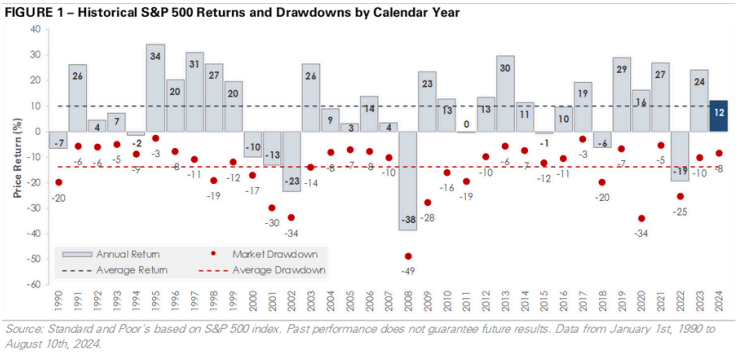

The stock market had a strong start this year. The S&P 500 gained over +15% in the first six months, its 16th strongest first-half return since 1931. The equity market’s rise continued into early July, and the index set a new all-time closing high on July 16th. However, the stock market experienced increased volatility as it traded lower over the past few weeks. History shows that stock market drawdowns are a natural part of investing. The chart below graphs the S&P 500’s price return each year since 1990. The navy line shows the index has produced an average annual return of nearly +10%, but the bottom half of the graph shows a lot can happen within the market throughout the year. The red dots show the S&P 500’s biggest intra-year decline in each year. Since 1990, 32 of 35 years have had an intra-year selloff of -5% or more. Stock market volatility is the price of admission for investing. This year, with a US Presidential election looming and plenty of chaos around the world, it is easy for investors to become especially anxious about market conditions. However, in the end the market is primarily interested in one thing: EARNINGS. With over 90% of companies reporting, S&P 500 earnings grew more than +10% year-over-year in the second quarter. Wall Street analysts expect an additional +10% earnings growth over the next 12 months. Unemployment is rising but remains low by historical standards. Consumer sentiment is improving as inflation eases, and retail spending continues to grow. The chart below is a timely reminder of why we invest with a long-term mindset.

Disclaimer: The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. While efforts are made to ensure information contained herein is accurate, Lokken Investment Group, LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. This message is intended to be educational in nature and does not represent tax or legal advice. Lokken Investment Group, LLC is neither an accounting firm nor a law firm, and we encourage the reader to consult a tax or legal expert for specific tax or legal advice. The information provided is derived from sources deemed to be reliable, but we are unable to guarantee its reliability. For more information about Lokken Investment Group, LLC and services provided, please contact us at jlokken@lokkeninvest.com or 302-645-6650