Chart of the Month | April 2024

Rising Manufacturing Orders Signal Future Economic Growth

The Institute of Supply Management (ISM) conducts a monthly survey that focuses on the manufacturing industry. The survey asks purchasing and supply managers from over 400 manufacturing companies and 20 different industries about their business and operations. Investors and economists follow the survey closely because it can provide context about broader economic conditions.

The survey question about new orders asks if orders increased or decreased compared to the prior month. Readings above 50 indicate orders increased, while readings below 50 indicate orders decreased. Why do new orders matter? It’s because purchasing decisions must be made in advance to meet future manufacturing needs. If orders rise and a company expects to increase production, it must buy the required raw materials and other manufacturing inputs months ahead. As a result, rising orders are viewed as a positive for the economy.

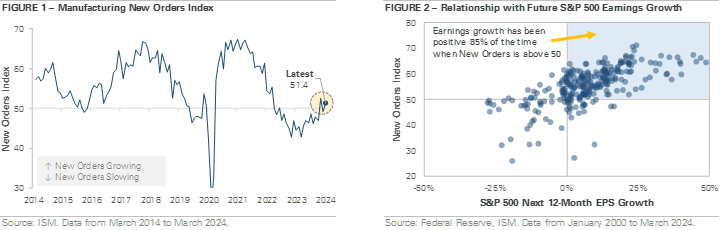

The far-right side of Figure 1 shows the New Orders index climbed above the key 50 threshold in January 2024, the first time in 16 months. The rise above 50 indicates that manufacturing activity may be starting to expand again, but it also provides insight into corporate earnings. Figure 2 compares the New Orders subindex against the S&P 500’s year-over-year earnings growth. In general, earnings growth tends to be stronger when the New Orders index is higher. If the New Orders index remains above 50 in expansion, it could be a positive signal for the economy and earnings.

Disclaimer: The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. While efforts are made to ensure information contained herein is accurate, Lokken Investment Group, LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. This message is intended to be educational in nature and does not represent tax or legal advice. Lokken Investment Group, LLC is neither an accounting firm nor a law firm, and we encourage the reader to consult a tax or legal expert for specific tax or legal advice. The information provided is derived from sources deemed to be reliable, but we are unable to guarantee its reliability. For more information about Lokken Investment Group, LLC and services provided, please contact us at jlokken@lokkeninvest.com or 302-645-6650