Chart of the Month; February 2024

Labor Market Strength: Why Hasn’t the U.S. Unemployment Rate Risen Further?

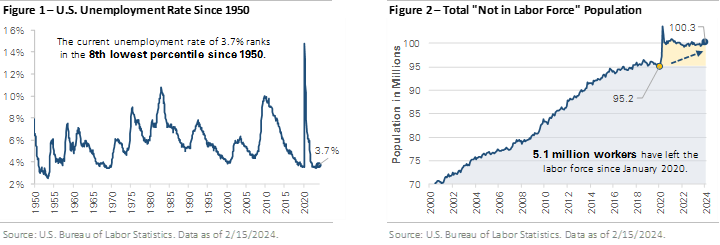

The unemployment rate in the U.S. is currently 3.7%, which is low compared to historical standards. This is notable considering that during the past two years the U.S. economy experienced one of the sharpest rises in interest rates on record. Traditionally, one would expect to see unemployment rise as interest rates rise, the economy slows, and businesses scale back operations and reduce their workforce in response to the changing economic environment. Why does the unemployment rate remain low today?

One contributing factor is the group classified as “Not in Labor Force”, which tracks the number of retired persons, students, individuals taking care of children or other family members, and others who are not seeking work. Early in the pandemic, many individuals left the labor force due to virus concerns and childcare responsibilities. While some of those workers have come back, Figure 2 shows there are 100.3 million individuals not in the labor market, an increase of 5.1 million from January 2020.

Where are those workers? The labor force participation rate by age group offers potential insight. The participation rate for individuals aged 25-54 increased from 83.1% in January 2020 to 83.3% in January 2024. In contrast, the rate for those aged 55 and over decreased from 40.2% to 38.5% over the same period. This divergence suggests that workers nearing retirement accelerated their retirement plans. If those individuals hadn’t retired early, the unemployment rate might be higher today.

The increase in the number of individuals classified as not in the labor force significantly alters the labor market landscape. This structural change has likely provided an unexpected buffer, keeping employment levels tight and mitigating what might historically have led to a rise in unemployment. It should be noted that unemployment is a lagging indicator and could rise as higher interest rates make more of a cumulative impact. However, with the unique circumstances of this economic cycle, the ceiling on unemployment may be lower with a smaller rise than in prior cycles. The pandemic has passed, but its effects continue to linger.

Disclaimer: The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-lookingstatements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, noentity is able to accurately and consistently predict future market activities. While efforts are made to ensure information contained herein is accurate, Lokken Investment Group, LLC cannotguarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. This message is intended to beeducational in nature and does not represent tax or legal advice. Lokken Investment Group, LLC is neither an accounting firm nor a law firm, and we encourage the reader to consult a tax or legalexpert for specific tax or legal advice. The information provided is derived from sources deemed to be reliable, but we are unable to guarantee its reliability. For more information about LokkenInvestment Group, LLC and services provided, please contact us at jlokken@lokkeninvest.com or 302-645-6650